Is A Money Market Account A Savings Vehicle

6 Min Read | Sep 27, 2021

When y'all were little, saving money looked like putting every dime of your allowance in a piggy bank. The plug in the bottom was hard to open, and the slit at the top was likewise small for your chubby little fingers to fit through. So when the ice cream truck came around, it seemed impossible to get your coin out—and for good reason. Whether you realized it or not, that hard-to-open up piggy bank was teaching you how to save your money.

And now that you're older and saving for things that are much more expensive than an water ice cream sandwich, y'all actually can't afford to pull the plug on the piggy depository financial institution. But y'all also need a better place to park your money. You've probably heard that your best two options for saving are money market accounts and savings accounts.

But which is better? Don't worry—we've got the scoop on when it's right for you to use a money market versus savings business relationship.

What Is a Savings Account?

A savings account is a gratuitous account you can open with your local bank. It gives you a rubber place to put your hard-earned money that you lot won't (or shouldn't) be touching for a while. You lot might be asked to keep a minimum balance in your savings account at all times, but your bank could throw in a costless checking account.

Calculate the growth of your money marketplace account with this complimentary tool.

Remember of it this way: Checking accounts and savings accounts are inseparable all-time buds. They doeverythingtogether. But on top of having your checking account'south back in case of an overdraft, the savings account can actually earn you lot money. If we're honest, it's zero to write home about. We're talking pennies on the dollar . . . but that'due south okay! With this savings account, yous're non worried nigh your charge per unit of render. Think of it equally a safer version of your beloved childhood piggy bank.

What Can I Wait From a Savings Account?

From an everyday, run-of-the-manufactory savings account, y'all tin can expect:

- A limited number of transfers or withdrawals per month (no more than half dozen)ane

- A (very) modest charge per unit of interest

- A safe place to keep coin y'all won't be using for a piddling while—ahem, like your starter emergency fund

Also, be enlightened of any fees that come with a new savings business relationship. A lot of the fourth dimension, you lot'll take to meet a minimum residual to escape them.

What Is a Money Market Business relationship?

A money market account is a type of savings account that gives you lot a adventure to earn a higher rate of interest on your account balance, go on your money rubber and sound, and accept more than access to your account than a typical savings business relationship (think checks and debit cards). You lot'll probably also need to make a college initial deposit or keep a college monthly balance in your money market account.

The coin market business relationship and the savings account are kind of like siblings. They've got similar Deoxyribonucleic acid, just they however look (and act) a petty differently. That being said, there are a few places where you could open your money market business relationship:

- Your local bank

- An online bank

- A mutual fund company

Similar we said before, money marketplace accounts give you lot the opportunity to earn a college rate of interest on your account residual. But mind closely:Your master goal in using a money market account isn't to brand coin.That comes later.

Go on in mind that if you're still paying off all of your debt, you might non want to open a money market account with a common fund company. There's a higher risk of losing your hard-earned money in the short term and less liberty to cover those unexpected emergencies.

Money Market vs. Savings: What'due south the Difference?

Here's the deal: Both money market accounts and savings accounts are great for stockpiling cash. The biggest departure you'll find between money market accounts and savings accounts is the corporeality of access you take to your money. A savings account limits y'all to 6 or so transactions per calendar month, while a coin market account gives you the freedom—and flexibility—of writing checks. It sometimes even comes with a debit card.

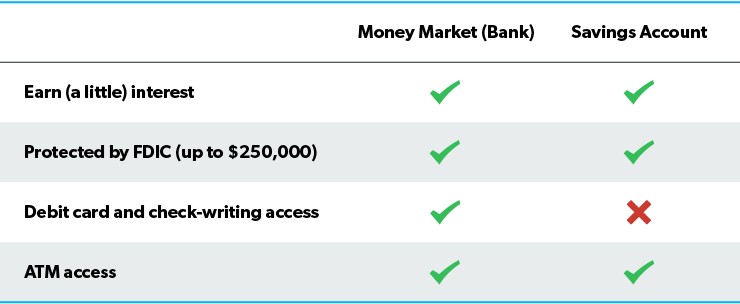

Allow'due south compare money market place and savings accounts a little more closely:

Both money market accounts and savings accounts at banks protect y'all in case your bank goes under. The FDIC, or Federal Deposit Insurance Corporation, will encompass your deposits in both of these accounts all the fashion up to $250,000. But not all money market accounts have this luxury.

Quick note: Money market accounts are very unlike from money market fund accounts (sometimes chosen money market common funds). Money market funds alive in the investment world—which means if you park your savings there, you're taking the risk of losing your money. Only if yous're not ready to beginning investing and you're just looking for a skillful identify to save some greenbacks, you'll want to stick a regular coin market account at a trusted depository financial institution.

Both a coin market and savings account also give you the opportunity to earn involvement—a really small amount of involvement—depending on your banking company'southward current rates. Simply don't forget: This is a savings business relationship. You're not really trying to make money on this money. You're trying to salve for specific purposes similar emergencies, a downwardly payment on a house, a family vacation, or even next year's Christmas fund.

Which Account Should I Cull?

Hither'south the thing: It really depends on where y'all're at in your wealth-edifice journey—or equally we telephone call them, the 7 Babe Steps.

Baby Step 1 is saving up $ane,000 strictly for emergencies. That starter emergency fund would work best in a regular ole savings account—specially because some coin market place accounts require a minimum eolith higher than $1,000.

Past putting your starter emergency fund in a savings account, you'll still exist able to access it, but it'll exist a lilliputian harder than swiping a carte or writing a check to get to it. Of course, you lot'll still have the ability to brand online transfers between your checking and savings accounts. (Call back: Your checking and savings accounts are all-time buds.) This is where discipline comes in—don't touch it!

You'll leave that $i,000 in there equally y'all work on tackling all of your debt (Baby Step 2). Once you're debt costless (woo!), you'll start working on saving three to six months of expenses in a fully funded emergency fund (Baby Step three). Equally you see those dollar signs add up, you'll want to put that cash in a money market business relationship. Not only will it be condom and secure, but you lot'll also have better access to it in case life throws a surprise your way.

No matter where you're at, saving for life's big events is always a good idea. Larn how to walk the Babe Steps one footstep at a time in Financial Peace University—available just in Ramsey+. FPU has helped millions of people acquire how to give, save and spend similar no ane else. And your Ramsey+ membership too comes with access to the premium version of the EveryDollar budgeting app to track your spending and savings.

Start your Ramsey+ free trial today!

About the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/banking/money-market-vs-savings

Posted by: decarloelows1972.blogspot.com

0 Response to "Is A Money Market Account A Savings Vehicle"

Post a Comment